Why is overnight funding charged and how is it calculated?

If you hold a short-term trade and want to keep it open overnight, you’ll be charged a daily interest fee. This charge will be applied to forex positions held through the daily cut off time.

The daily cut off time is 5pm ET.

WHY IS OVERNIGHT FUNDING CHARGED?

To keep your position open after the daily cut off time an interest adjustment will be made to your account to reflect the cost of funding your position overnight, plus a small admin fee - 0.5% per year.

More info on costs and charges can be found here.

HOW CAN I SEE WHAT I’VE BEEN CHARGED?

Overnight funding charges appear as separate transactions on your account and won’t affect your running profit/loss. A statement which contains all trades and associated charges is automatically sent to your registered email address at the end of each day.

HOW IS OVERNIGHT FUNDING CALCULATED FOR FOREX?

For forex positions, we charge the tom-next rate plus an admin fee of 0.5% per year.

Please note that forex positions held through Wednesday 5pm ET will typically incur three days’ worth of funding to cover the settlement of trades over the weekend. This is because FX settles on a T+2 basis. Therefore, when a position is held through Wednesday 5pm ET it’s effectively being held through the weekend as positions can’t be settled until after Friday 5pm ET. Subsequently, holding through Friday will only incur one day’s worth of funding. It should also be noted that bank holidays are non-settlement days as well, and should be considered when executing and/or holding positions. In some instances, this can lead overnight settlement of more than three days' worth of funding.

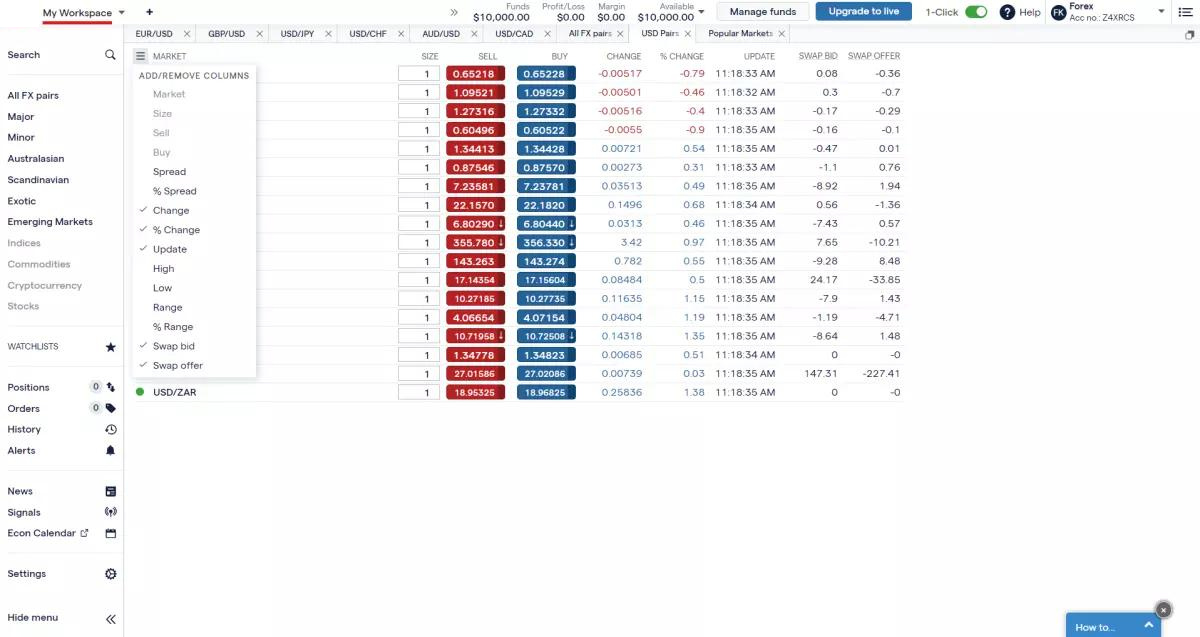

How to view swap rates in platform:

Open a watchlist in the 'WATCHLISTS' tab of the platform. Click on the three horizontal bars at the top-left section to 'ADD/REMOVE COLUMNS,' and add 'Swap bid' and 'Swap offer' to watchlist.

What is the base calculation for FX funding?

Formula:

There are three steps to this formula:

- Value

Price in points x 0.5% ÷ 360 - Swap rate

When going short:

Tom-next rate – value

When going long:

Tom-next rate + value - Cost

Number of contracts x value of contract x swap rate

Examples:

Tom-next credit

- You’re short one EUR/USD standard lot

- The contract value is $10

- The tom-next rate is 0.34 bid/-0.39 offer

- The closing spot price is 1.0650

Value = 10650 x -0.5% ÷ 360 = -0.14792

Swap rate = 0.34 – 0.14792 = 0.19 (rounded)

Cost = 1 x $10 x 0.19 = $1.90 credit

Tom-next debit

- You’re long one EUR/USD standard lot

- The contract value is $10

- The tom-next rate is 0.34 bid/-0.39 offer

- The closing spot price is 1.0650

Value = 10650 x -0.5% ÷ 360 = -0.14792

Swap rate = -0.39 + (-0.14792) = -0.54 (rounded)

Cost = 1 x $10 x -0.54 = $5.40 debit