What is a limit order?

Discover everything you need to know about limit orders, including what they are, how to place one, and their benefits and risks.

Forex Order Types: Limit Order

Popular order types for trading forex include market and limit orders. Market orders attempt to execute your order immediately regardless of specific prices, while limit orders wait for a predetermined price to execute.

Limit orders trade expediency for specificity, but they might not be executed if the market does not reach the price level chosen for the order. Learn the particulars of limit orders as well as how to use them.

1. What is a limit order?

A limit order is an instruction for your broker (tastyfx, for example) to enter or exit a trade if the market moves in your favor and the price hits a certain predetermined level.

The level will generally be determined by you and it’ll depend on whether you’re going long or short, and entering or exiting a trade.

2. What are the two types of limit orders?

There are two types of limit orders: limit closing orders and limit entry orders.

1. A limit entry order

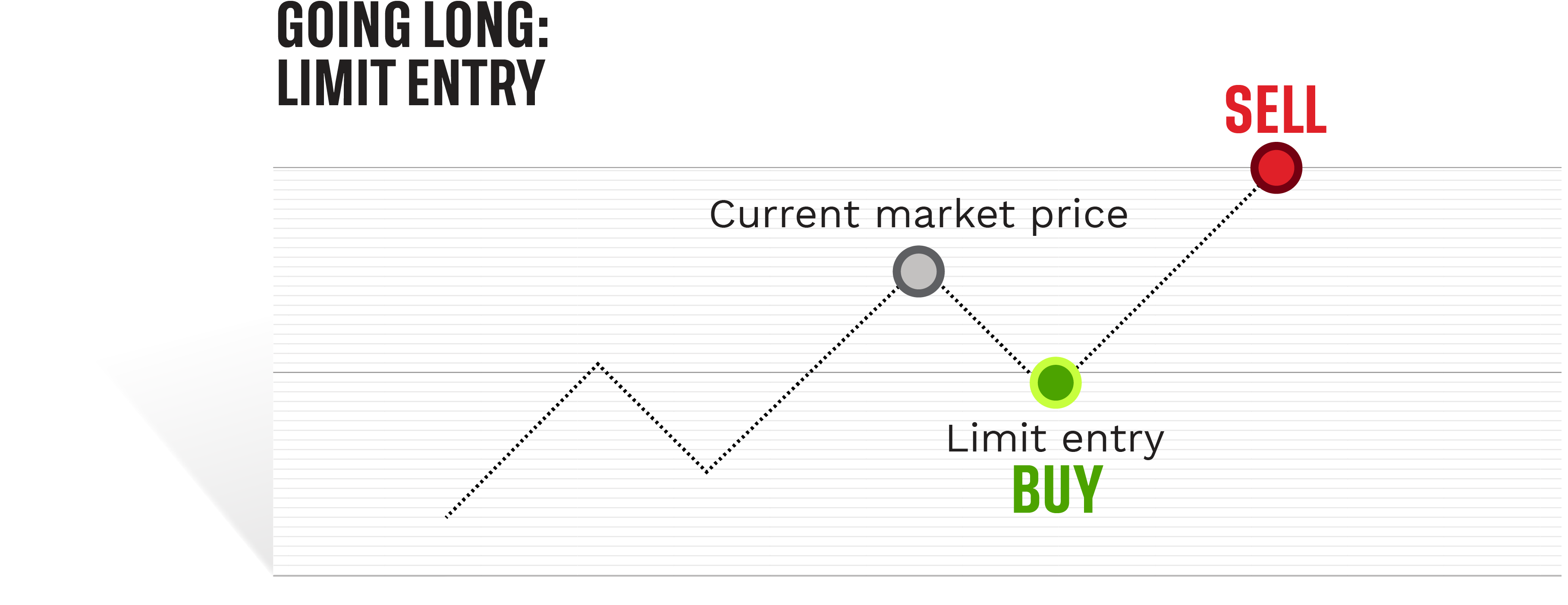

This is an order to open a position when the market is moving in a favorable direction for you, according to your predictions. It ensures that you’re automatically entered into a trade if the underlying market price reaches your predetermined level. A limit order will always be an order to open a position that is better for you than the current market price, the alternative being a market order. So:

- If you’re buying (going long)—you think the price will rise—the limit entry order level will be below the current price

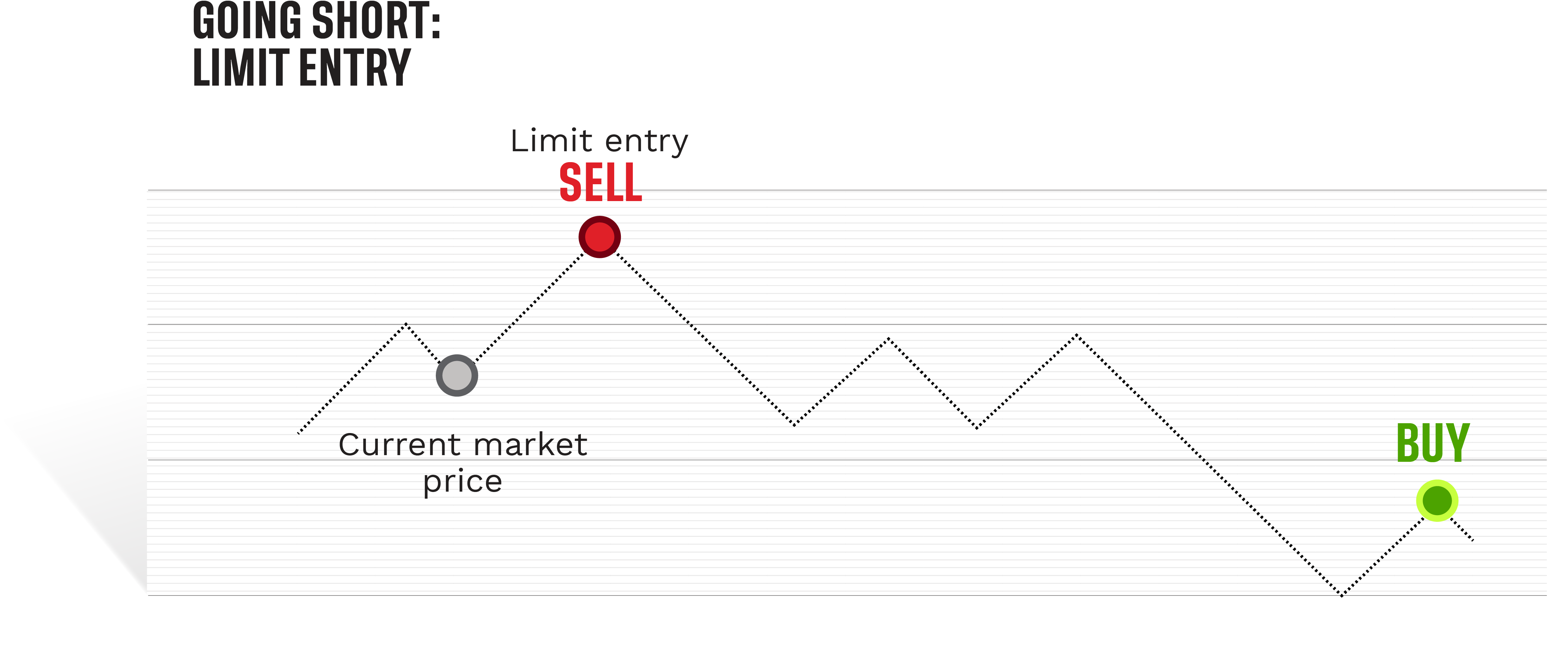

- If you’re selling (going short)—you think the price will fall—the limit entry order will be above the current price

2. A limit closing order

This is an order to automatically close your position when it’s reached a certain level, thereby securing possible profits and avoiding potential future loss, if the market turns. Potential losses can still be seen, however, if the limit closing order is never reached.

A limit closing order is usually set at a more favorable price than your opening position and always at a more favorable price than the current price. So:

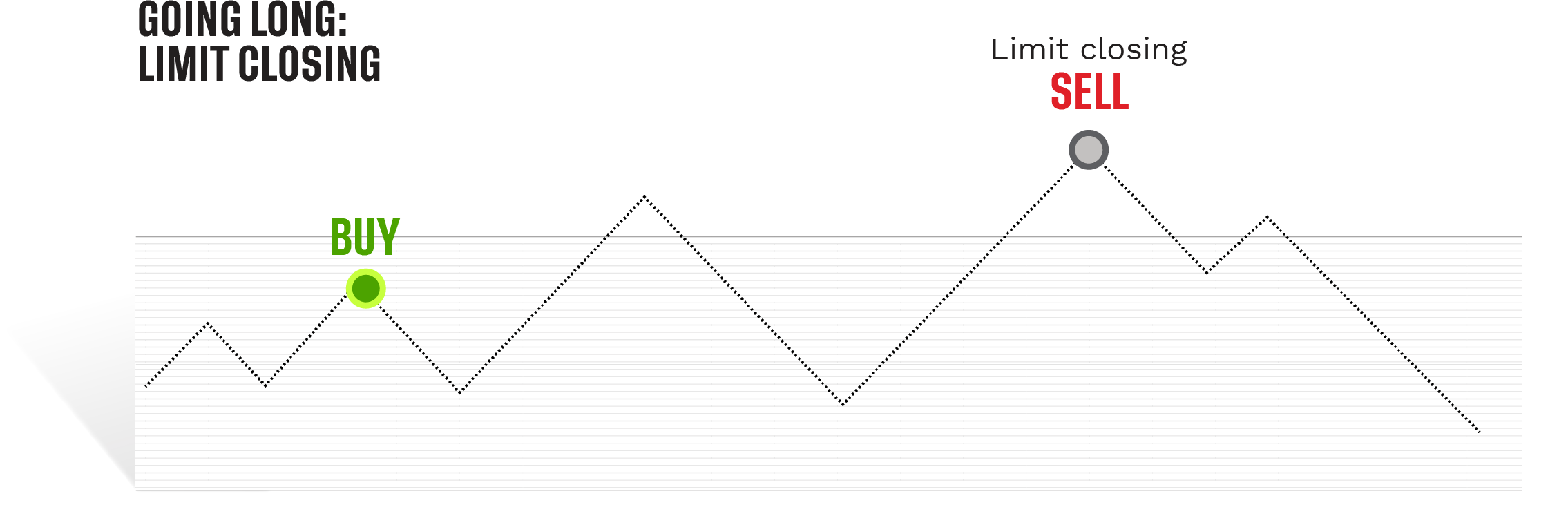

- If you have a long position open, you’d set the limit order above the market price at the level you want to exit your trade

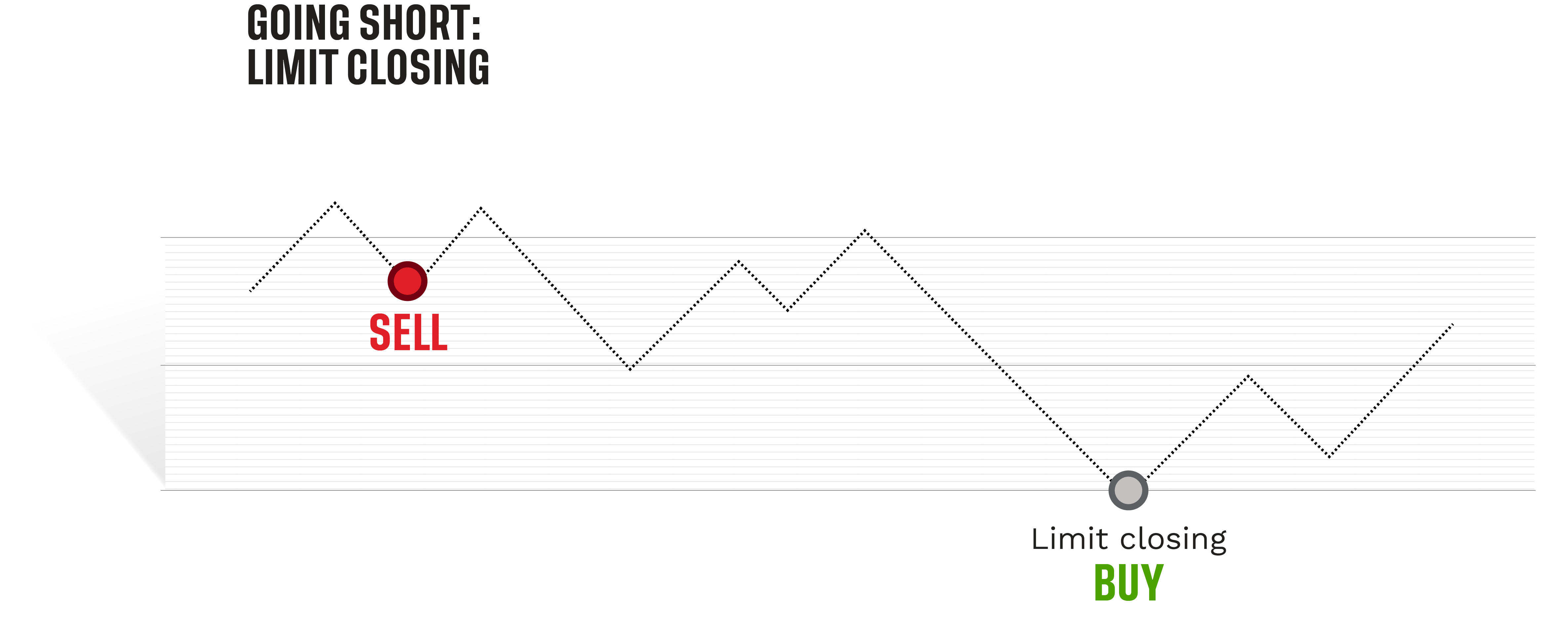

- If you have a short position open, you’d set the limit order below the market price at the level you want to exit your trade

3. How do limit orders work?

Limit orders work by entering you into or out of a trade when the market reaches a certain price point as set by you. This is done automatically, with our system doing the rest as soon as you’ve entered your parameters.

This is so you don’t have to watch the market constantly for if prices will move in your favor. Limit orders are especially useful in volatile markets when prices change suddenly and you won’t always have time to manually close or open a trade that’s turned profitable or in the direction of your limit order. In especially volatile periods, however, limit orders are at risk of not being filled, and they will not be filled if the market does not move to your limit order price.

How limit entry orders work

You can set a limit entry order when forex trading on our platform. A limit entry order will be manually determined by you at the level at which you would want to open a position, if the market moves in your favor. When that price level is reached, your limit entry automatically opens a position for you without your having to do anything.

How limit closing orders work

You can also set a limit closing order. A limit closing order is also manually determined by you. When opening a position, you can set a limit closing order as the amount of profit you’re happy with making, if the market moves in your favor. Then, when that price level is reached, your trade is automatically closed, thereby locking in potential profits.

You can also set a limit closing order for already open positions at a price more favorable than the current market price.

4. How to place a limit order

The method you’ll use of placing your entry order will differ slightly depending on the platform.

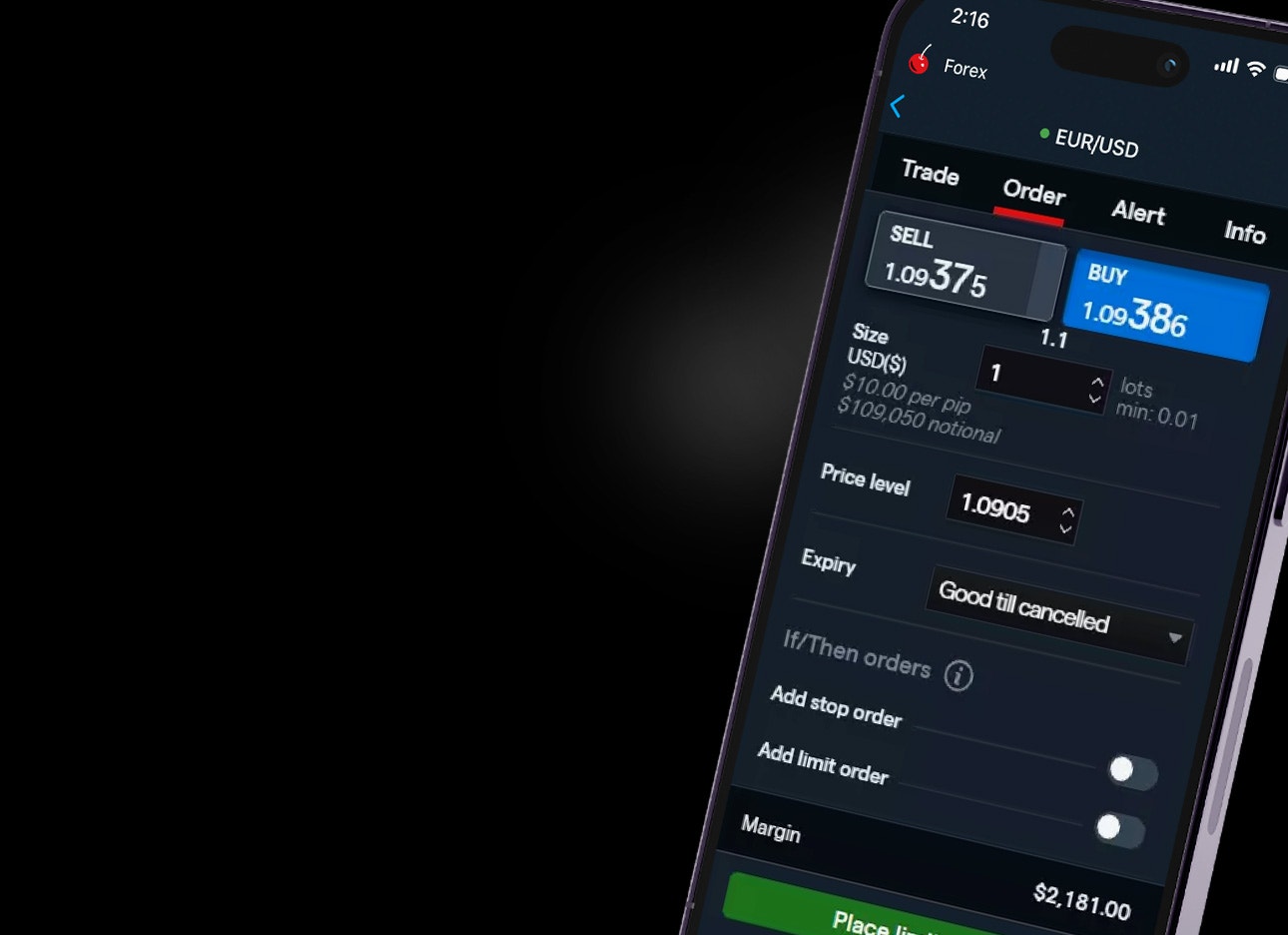

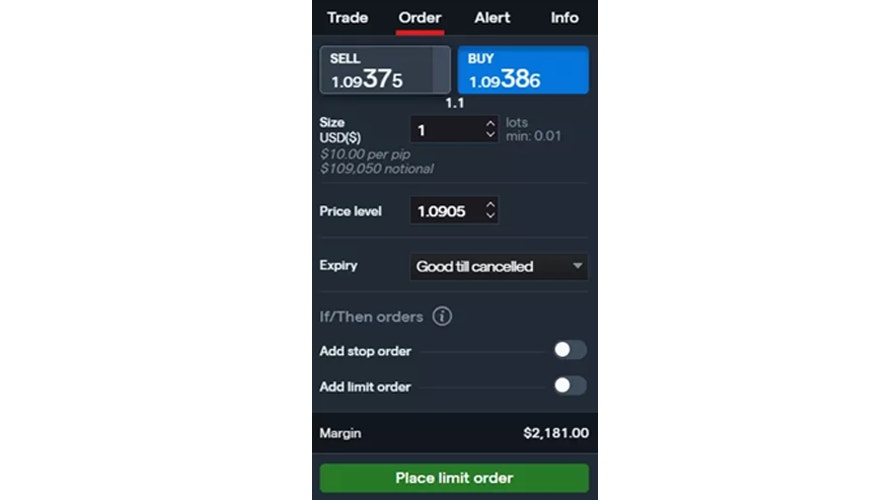

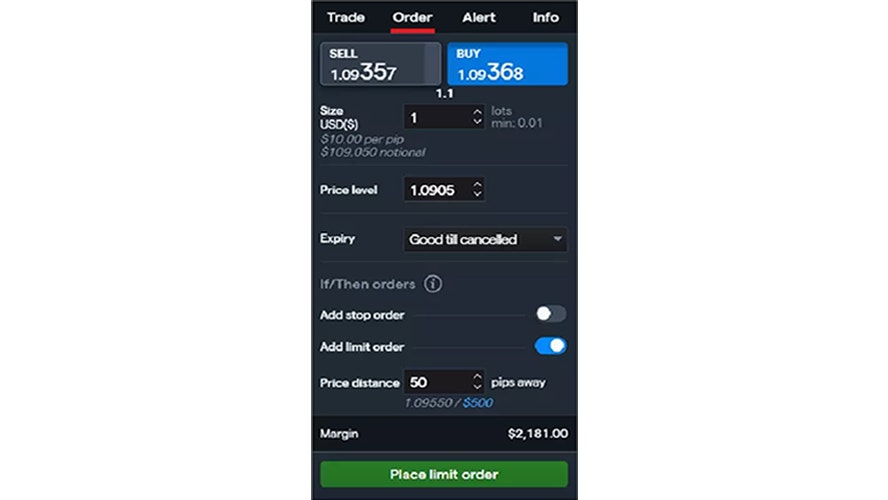

How to place a limit entry order on our trading platform:

- Open a trading account to get started, or practice on a free demo account

- Conduct technical analysis and fundamental analysis in the market you want to trade

- Pick your price level. This is the amount at which you want the limit order to automatically open a new position

- Choose between a ‘good till cancelled’ order, which will run until the predetermined price level is met, and a ‘good till date’ order, which will close out automatically on a predetermined future day

- Open your trade by clicking ‘Place limit order’

How to place a limit closing order on our trading platform:

- Open a trading account to get started, or practice on a free demo account

- Conduct technical analysis and fundamental analysis in the market you want to trade

- Pick your price level. This is the number of points away from the opening price you want your limit closing order to be triggered at. Set this limit closing order by entering a price distance value in the 'Add limit order' section

- Open your trade by clicking ‘Place limit order’

You can also add or edit a limit closing order once your position is open. Go to 'Positions' on our web platform or app, and select the price level you want the limit closing order to be triggered at.

5. What are the benefits and risks of using limit orders?

Benefits of using limit orders

- You can set a price level to open or close a position, where your order can be bought/sold at that price or better.

- You won’t need to constantly monitor the market, waiting to manually open or close a trade at the right time; though, forex trading does involve risk, and positions should be checked regularly.

- You can access potentially lucrative positions in volatile markets whenever you may not have time to manually open or close a trade, but an automatic limit order can still trigger.

- In the case of very volatile markets, this could even lead to a phenomenon called ‘positive slippage’—where the market suddenly moves beyond your set amount, fulfilling your order at an even better price than your limit order expected.

Risks of using limit orders

- There is the chance that a position may never be opened, which could affect your trading strategy, because a limit order is ‘your set price or better’.

- Limit orders do not protect against loss—stop orders can help with that. So, even if you have a limit order in place, without a stop order your potential for loss is uncapped should the market move unfavorably. Learn more about stop orders.

- Your position could be opened but, with a sudden market downturn or upswing, it’d be at a loss straight away. And if you were using a limit closing order, there’s the risk that any movements might prevent your order being triggered at the price level at which it was set, which could impact your profit.

6. Limit order example

Let’s say you want to go long EUR/USD with forex trading, and it's currently priced at 1.1000. You’ve conducted your own analysis and believe that EUR/USD will likely go up briefly, then fall to a price of 1.0750.

So, you decide to set up a limit entry order to automatically buy (go long on) 1 lot of EUR/USD when the price hits 1.0750.

After a few days, EUR/USD hits 1.0750 as predicted and your limit entry order takes effect, automatically buying 1 lot of EUR/USD. You decide that you want to close the position when the price reaches 1.0925, so you set a limit close order.

If EUR/USD climbs to 1.0925, your limit closing order will automatically close out the trade, locking in your profits of $1,750 ([1.0925 sell price – 1.0750 original buy price] x $10 per point).

However, if the price level of the limit closing order is not reached, then the position would continue to fluctuate to the point of losses. Setting limit orders does not guarantee execution for opening or closing positions.

.jpg?format=pjpg&auto=webp&quality=90)

Open your forex trading account today

It’s free to open an account and there’s no obligation to fund or trade.

.jpg?format=pjpg&auto=webp&quality=90)

Open your forex trading account today

It’s free to open an account and there’s no obligation to fund or trade.