Best times to trade forex

What are the forex market hours?

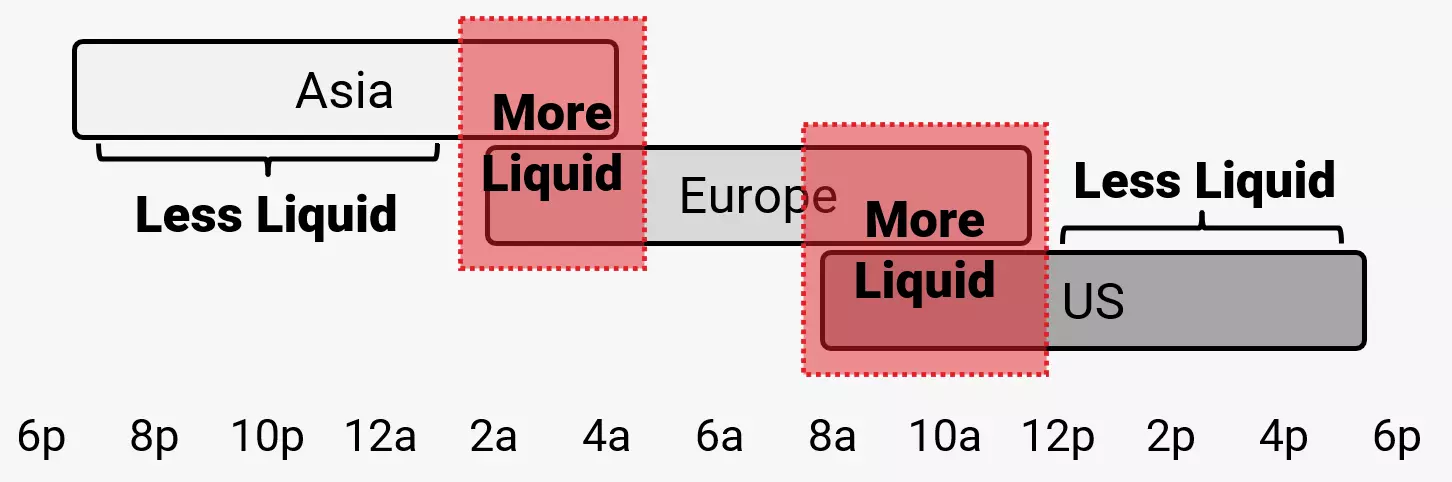

The forex market operates 24 hours a day, opening at 5pm Sunday and closing at 5pm Friday (EST), providing continuous access to over 80 currency pairs throughout the week. Despite this uninterrupted availability, the liquidity and volatility within the forex market can be significantly influenced by the trading hours of other financial markets.

Forex trading hours around the world

Market | Time (EST) |

Sydney | |

Start | 5pm |

End | 2am |

Tokyo | |

Start | 7pm |

End | 4am |

London | |

Start | 3am |

End | 12pm |

New York | |

Start | 8am |

End | 5pm |

Overlaps in forex trading hours

These markets have a few hours of overlap each day. With both exchanges trading simultaneously, forex markets tend to increase in liquidity. Traders can directly benefit from this trend through decreased spreads in certain pairs. For example, during the London-New York overlap, traders will likely look to EUR/USD for increased activity and spreads as low as 0.8 pips.

Volatility and data releases

The overlaps in trading sessions can also result in greater volatility across forex pairs. The graph below of EUR/USD over the past week highlights the major movements corresponding to the London-New York alignment.

Price action can also result from economic data releases. Important metrics that help gauge a country’s economic health such as GDP, unemployment and inflation are often released towards the beginning of market hours. Central banks will also meet during their region’s trading session. In these instances, traders can expect a more liquid and possibly volatile market immediately following data releases.

For the US, 8:30am and 10am EST are popular times for data releases. European countries often report data from 2am to 5am EST, and Asian countries from 7pm to 11pm ET.

When is the best time to trade forex?

While there is no undisputed "best" time to trade forex, 8am - 12pm EST is an optimal time for traders to experience high liquidity and volatility. In this four hour period, the London and New York sessions overlap and the US releases a majority of their key economic data points. This overlap brings a high number of active participants into forex markets, and US data provides potential volatility for USD pairs.

How to trade forex 24/5

- Open an account to get started, or practice on a demo account

- Choose your forex trading platform

- Open, monitor, and close positions on forex pairs

Trading forex requires an account with a forex provider like tastyfx. USD/JPY can be found in tastyfx's platform under the 'Major' pairs tab. Many traders also watch major forex pairs like GBP/USD and USD/JPY for potential opportunities based on economic events such as inflation releases or interest rate decisions. Economic events can produce more volatility for forex pairs, which can mean greater potential profits and losses as risks can increase at these times.

You can help develop your forex trading strategies using resources like tastyfx’s YouTube channel. Once your strategy is developed, you can follow the above steps to opening an account and getting started trading forex.

Your profit or loss is calculated according to your full position size. Leverage will magnify both your profits and losses. It’s important to manage your risks carefully as losses can exceed your deposit. Ensure you understand the risks and benefits associated with trading leveraged products before you start trading with them. Trade using money you’re comfortable losing.

This information has been prepared by tastyfx, a trading name of tastyfx LLC. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. No representation or warranty is given as to the accuracy or completeness of the above information. tastyfx accepts no responsibility for any use that may be made of these comments and for any consequences that result. See our Summary Conflicts Policy, available on our website.